LEGAL FEES

LEGAL FEES

Lawyers are legally obliged to give you a cost estimate upfront of their services. This is a good opportunity to get a strategy in place and think how are you going to cover these costs. With finance in place, you can you get the peace of mind you need, knowing you won’t have to worry about how to pay your legal fees. This will make the entire process stress-free for you and your loved ones.

WHY DO LEGAL FEES GET SO EXPENSIVE?

- Research

- Appearing in court

- Correspondence

- Reviewing documentation

- Negotiation

- Copying documents

- Witness expenses

- Retainer Fees

WHY DO LEGAL FEES GET SO EXPENSIVE?

- Research

- Appearing in court

- Correspondence

- Reviewing documentation

- Negotiation

- Copying documents

- Witness expenses

- Retainer Fees

HOW DOES IT WORK?

Without a cost strategy in place, you will need to pay the legal fees from your own savings, borrow from a family member or friend, or sell some of your assets.

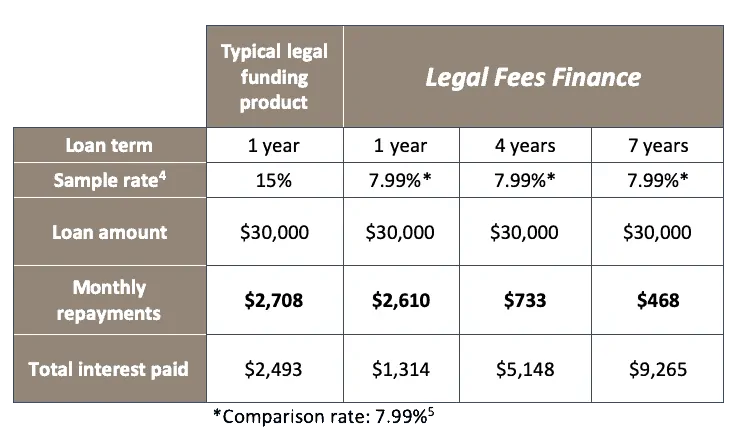

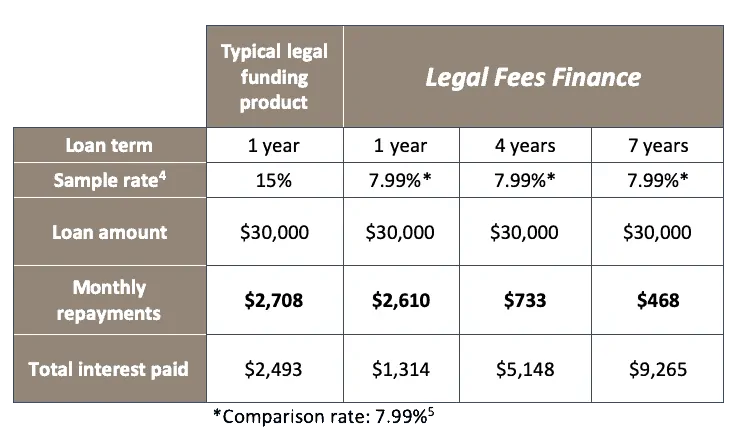

Some legal firms offer short-term funding loans, but this often means borrowing at rates around 16%, and are only repayable over a 1-year term. Eventually, this often results in high repayments, high default rates, and even penalties for early repayment.

HOW DOES IT WORK?

Without a cost strategy in place, you will need to pay the legal fees from your own savings, borrow from a family member or friend, or sell some of your assets.

Some legal firms offer short-term funding loans, but this often means borrowing at rates around 16%, and are only repayable over a 1-year term. Eventually, this often results in high repayments, high default rates, and even penalties for early repayment.

HOW ARE WE DIFFERENT?

- We give you more flexibility, so you can decide how you want to repay the loan.

- We provide a tailored loan for your needs, so it’s right just for you.

- We can provide you with the exact amount you need for your case.

- The cost of repayments can be spread between 1 and 7 years. The longer the loan term, the less monthly repayments 1.

HOW ARE WE DIFFERENT?

- We give you more flexibility, so you can decide how you want to repay the loan.

- We provide a tailored loan for your needs, so it’s right just for you.

- We can provide you with the exact amount you need for your case.

- The cost of repayments can be spread between 1 and 7 years. The longer the loan term, the less monthly repayments1.

WHY CHOOSE LEGAL FEES FINANCE WITH US?

- We give you more flexibility, so you can decide how you want to repay the loan.

- Choice of fixed or variable rates.

- No security necessary (maximum lend $50,000)

- Convenient and manageable repayment plans that suit your own circumstances and that can be spread over any term, between one and seven years.

- Choose between weekly, fortnightly or monthly instalments.

- If you require advice in other areas of lending, one of our consultants will also help you with this.

WHY CHOOSE LEGAL FEES FINANCE WITH US?

- We give you more flexibility, so you can decide how you want to repay the loan.

- Choice of fixed or variable rates.

- No security necessary (maximum lend $50,000)

- Convenient and manageable repayment plans that suit your own circumstances and that can be spread over any term, between one and seven years.

- Choose between weekly, fortnightly or monthly instalments.

- If you require advice in other areas of lending, one of our consultants will also help you with this.

Need help deciding how to best structure the loan and repayments?

Mortgage Calculators

Testimonials

READ WHAT THEY SAY ABOUT US

GOOD KNOWLEDGE OF THE MARKET

Service, responsiveness, knowledge of the market.

I couldn't recommend Gordon enough.

KNOWLEDGE AND ATTENTION TO DETAIL

Massive thanks to Gordon for his knowledge and attention to detail.

I highly recommend AMC.

AMAZING SERVICE

Gordon is great at what he does and provides amazing service.

Highly recommended!

SO HELPFUL...

Gordon... WOW!! So helpful with any questions I throw his way.

Thank you for all your help, I will send everyone your way.

Recent Articles

5 ways to improve the financial position of your business.

What You Might Not Know About Your Business As a business owner, you’re familiar with most aspects of your business.

First home buyer with a small business and partner with overtime PAYG income – Case Study

The Clients: Jackson and Pippa, two young Australians, have saved $40,000 to buy their first home in Brisbane, QLD, with

Bridging a loan to comfortable retirement: Case Study

Bridging Loan. The Clients: Mr and Mrs Selassie, retired in their early 80s, own a $1m home in Melbourne and